There will be no income tax up to ₹7 lakh in the new tax regime, announced Union Finance Minister Nirmala Sitharaman in the Union Budget 2023 on Wednesday. “The government proposes to increase income tax rebate limit from ₹5 lakh to ₹7 lakh in the new tax regime,” said Sitharaman.

The finance minister also proposed to hike tax exemption on leave encashment on the retirement of non-government salaried employees to ₹25 lakh from ₹3 lakh.

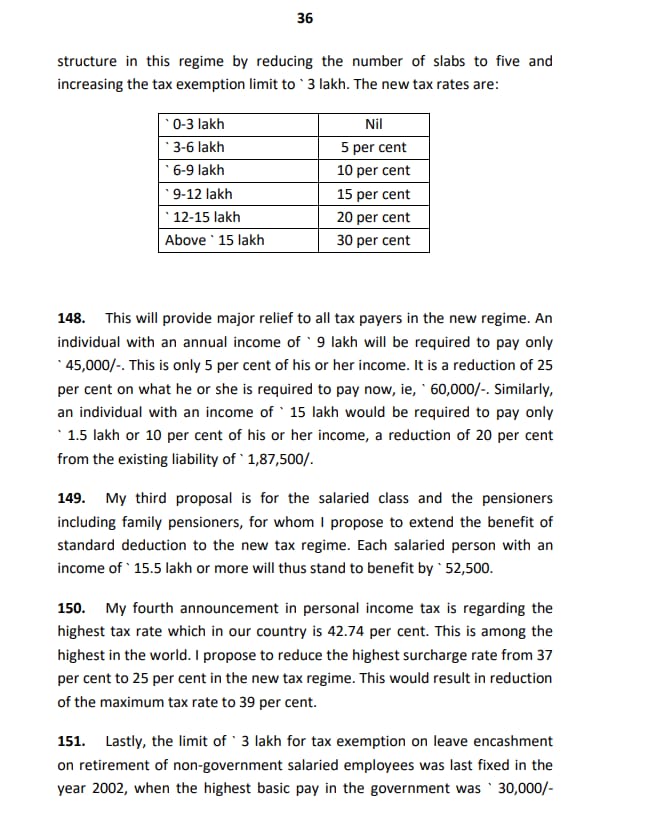

Revised tax slabs under new tax regime:

Income of ₹0-3 lakh – Nil.

Income above ₹3 lakh and up to ₹5 lakh will be taxed at 5 per cent.

Income of above ₹6 lakh and up to ₹9 lakh will be taxed at 10 per cent the under new regime.

Income more than ₹12 lakh and up to ₹15 lakh to be taxed at 20 per cent.

Income above ₹15 lakh to be taxed at 30 per cent.

The new income tax regime will be the default tax regime while the citizens will have the option to be in the old regime as well, the finance minister announced.

Calculation: How much do you save?

An individual with ₹9 lakh annual income will pay ₹45,000 tax which is 5 per cent of the salary – a reduction of ₹15,000 from the present ₹60,000.

Sitharaman’s recent comments on knowing the “pressures of the middle class” had added to speculation she would put some money in the pockets of taxpayers.

The finance minister said India will focus on economic growth and job creation and cut down fiscal deficit. It was the government’s last full budget in Parliament before the 2024 Lok Sabha election.

The aim is to have strong public finances and a robust financial sector for the benefit of all sections of society, she said.

The government will target a budget deficit of 5.9 per cent of GDP for 2023/24, Sitharaman said, compared to 6.4 per cent for the current fiscal year.