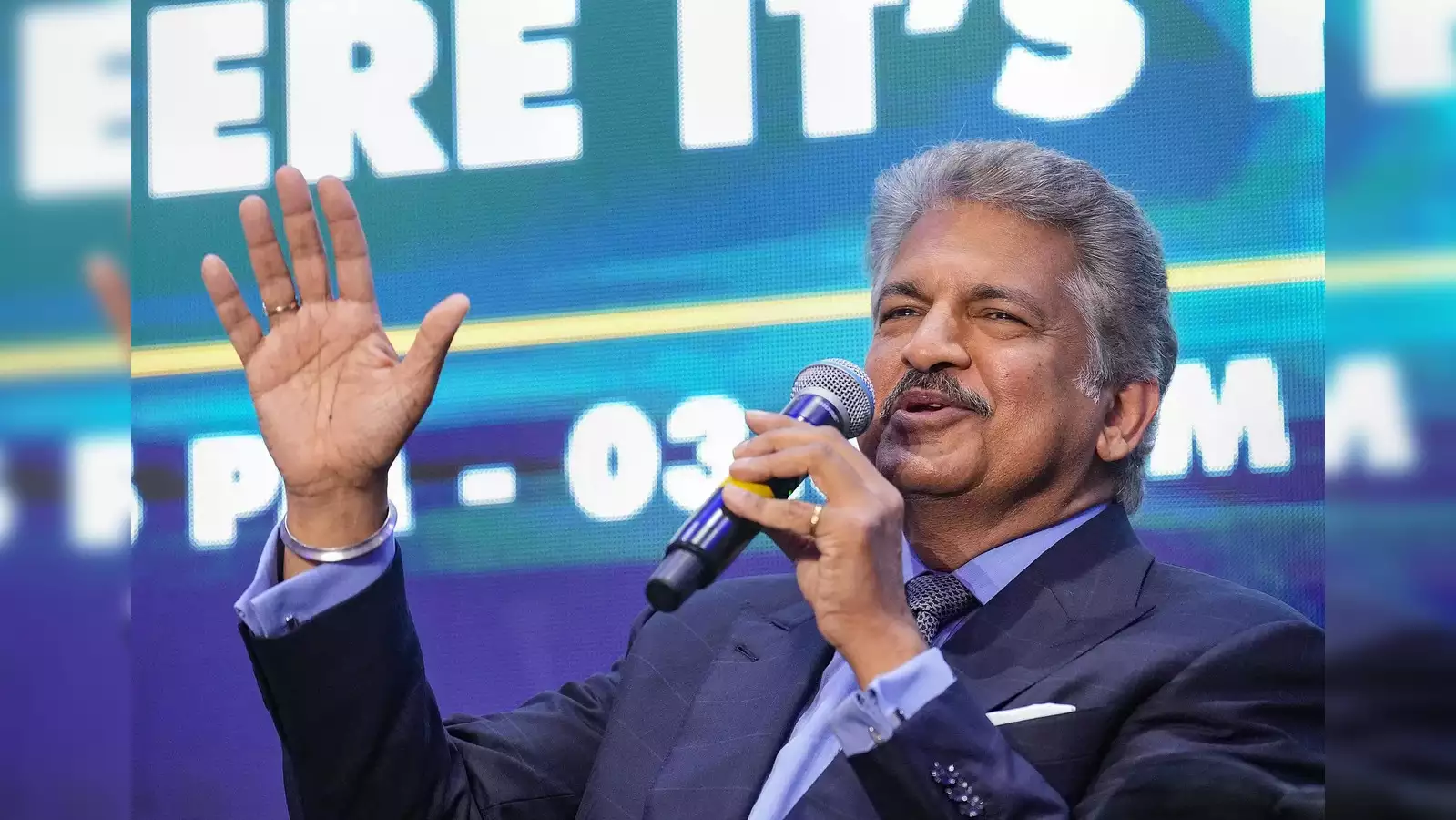

Indian companies need to enhance capital investment in order to take advantage of the growth opportunities available in India and abroad, according to Mahindra Group Chairman Anand Mahindra.

Addressing shareholders in the company’s annual report for 2023-24, the leading industrialist noted that the interplay of geopolitics and economic linkages in the post-COVID era has seen India’s position strengthen.

India’s emerging role as one of the vital nodes in future-proofed supply chains across industries opens the door for growth within the country and expansion beyond, he stated.

“How can we, in private industry, ensure that we ride this upsurging tide? ..In the spirit of ‘ask not what your country can do for you; ask what you can do for your country’, I would argue that the most important thing industry can do at this critical juncture is to increase private investment,” Mahindra said.

Private capital investment is the key to capitalising on this opportunity as it is a key driver of growth, jobs, and demand, he stated.

After the economic reforms of the 1990s, private investment rose from around 10 per cent to around 27 per cent of GDP, however, from 2011-12 onwards, private investment as a percentage of GDP has been falling to a worrisome level, Mahindra stated.

“We need to remedy that situation,” he added.

Mahindra noted that the problem is not one of resources—rather, it is one of mindset.

Particularly after COVID, Indian companies have become increasingly risk averse, sticking to the tried and true rather than blazing new trails, he said.

“To some extent, this is understandable. But when opportunity beckons, when private industry can make a significant difference, it is time to set aside our fear of failure and take a leap of faith and self-belief,” he noted.

It is undoubtedly a good time to be an Indian company, Mahindra said.

“The interplay of geopolitics and economic linkages in the post-COVID era has seen India’s position strengthen. A new multi-polar manufacturing world is emerging, as nations and companies rush to reconfigure their supply chains to be more resilient and diversified. India has emerged as a key beneficiary,” he added.

For private industry, particularly manufacturing, this confluence of factors translates into an excellent chance to be a serious player in this new, multi-polar world, Mahindra stated.

He noted that India has been heavily investing in infrastructure and logistics and the country has become the cheapest manufacturing destination in the world.

“Externally too, conditions are working in our favour. It’s time to seize the day,” he stated.

Elaborating on the Mahindra Group, he said, “On the back of this rising tide, we are stepping up our investments. We have already announced an investment of Rs 37,000 crore across our auto, farm and services businesses (excluding Tech Mahindra) in FY25, FY26 and FY27.”

These investments will, to a large extent, go towards building capacity, with a pipeline of 26 new models/facelifts in the next 5 years, he said.

The valuation of the company’s growth gems increased over fourfold in the last four years, Mahindra said.

The contribution of services businesses (Mahindra Finance, Tech Mahindra and growth gems) to M&M’s net cash generation was almost Rs 7,000 crore over the FY22-FY24 period, he said.

Mahindra & Mahindra MD and CEO Anish Shah said the company recognises the fact that private capital investment plays a crucial role in maximising the opportunities in India.

“By outlining a capex plan of Rs 37,000 crore for the next three years, we remain committed to our proven strategy of prudent capital allocation,” he stated.

The Mahindra Group draws confidence from the cash generation across businesses, low debt levels, and a robust balance sheet, he added. (PTI )